In October 2024, McKinsey forecasted a payments landscape defined by a paradox: smoother interfaces for end users, underpinned by increasingly complex infrastructure for those managing the flows behind the scenes.

Now, nearly halfway through 2025, we’re seeing those predictions play out in real time. The global payments ecosystem continues to evolve—with some trends accelerating faster than expected and others revealing surprising friction. Here’s a closer look at how the industry is unfolding against the backdrop McKinsey painted.

Market Growth Holds Steady, with Margin Pressure Rising

Global payments revenue is still growing, albeit at a slightly tempered pace—projected to hit $3.1 trillion by 2028. But a key dynamic is shifting beneath the surface: high-margin credit card volume is giving way to lower-margin, real-time account-to-account (A2A) payments.

As providers compete in this new landscape, payments orchestration, cost routing, and data optimization are becoming strategic imperatives—not just technical ones.

Instant Payments Are Gaining Ground

Cash continues its global decline, particularly in emerging markets. Instant payment systems like India’s UPI and Malaysia’s DuitNow are rapidly reshaping how consumers and businesses transact. Meanwhile, in the U.S. and EU, the growth of instant payments (Zelle, FedNow, SEPA Instant) is accelerating, especially for bill pay and peer-to-peer use cases.

This shift brings new complexity for enterprises: multiple networks, different compliance layers, and fragmented provider ecosystems that need to be orchestrated intelligently.

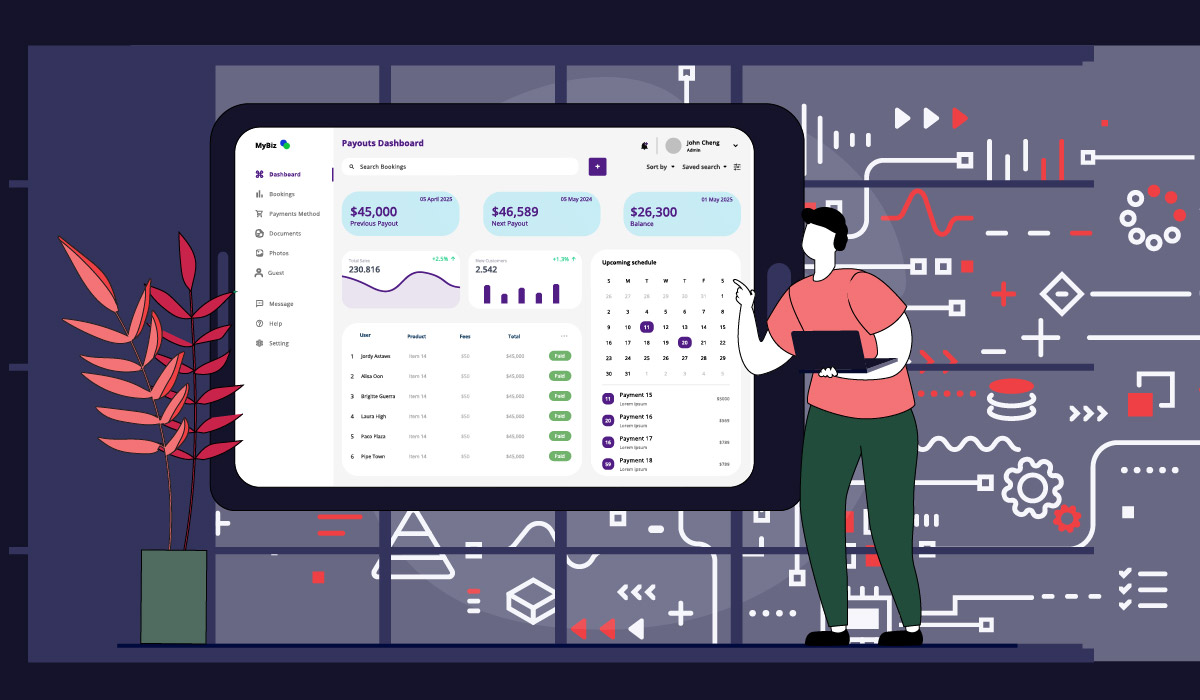

Corporate UX Expectations Are Transforming B2B Payments

Corporate users are demanding B2C-grade digital experiences. This is pushing transaction banks and fintech providers alike to modernize interfaces, unify reporting, and provide smarter cash flow tools. Leaders like Goldman Sachs and RBC are leaning into this shift with digital-first treasury services and embedded finance plays.

For businesses that rely on recurring revenue or high-volume transaction flows, “digital UX” now extends all the way to payment success and retry logic.

AI Moves from Buzzword to Backbone

Artificial intelligence is no longer hypothetical in payments—it’s operational. AI is now instrumental in fraud prevention, real-time transaction optimization, and personalized payment experiences. While SMBs are moving quickly to adopt these tools, large enterprises are still navigating legacy infrastructure and data compliance constraints.

For those managing AutoPay or subscription billing, AI-enabled retry strategies are beginning to show measurable lifts in payment success and customer retention.

The Rise of Digital Public Infrastructure

Countries like Indonesia, Peru, and Nigeria are investing heavily in digital public infrastructure (DPI)—from national digital IDs to interoperable real-time payment rails. These investments are unlocking faster, cheaper access to financial services for businesses and consumers alike, often leapfrogging legacy systems.

As DPI becomes more prevalent, expect to see more demand for orchestration layers that can interface across public and private payment schemes seamlessly.

CBDCs: Quiet but Strategic Progress

Central bank digital currencies (CBDCs) haven’t taken over headlines recently, but they remain quietly influential. As stablecoin alternatives, they’re pushing expectations around cost-efficiency, transparency, and central oversight.

While commercial adoption is limited, infrastructure investments from central banks are creating ripple effects in how cross-border payments and digital settlement systems are designed.

Simpler Interfaces, Still a Complex Reality

What’s perhaps most striking is how McKinsey’s central paradox still rings true: user-facing experiences have improved, but the architecture supporting those experiences is more complex than ever. Fragmented payment providers, rising regulatory requirements, and evolving customer expectations make payment optimization a strategic challenge.

Modo POV

As payment options proliferate and business models evolve, companies need smarter ways to manage, optimize, and future-proof their payment flows. Whether it’s recovering failed AutoPay transactions or routing payments to lower-cost providers in real time, we’re helping businesses turn payments into a performance advantage.

Curious how your payment flows stack up in this new landscape? Let’s talk.