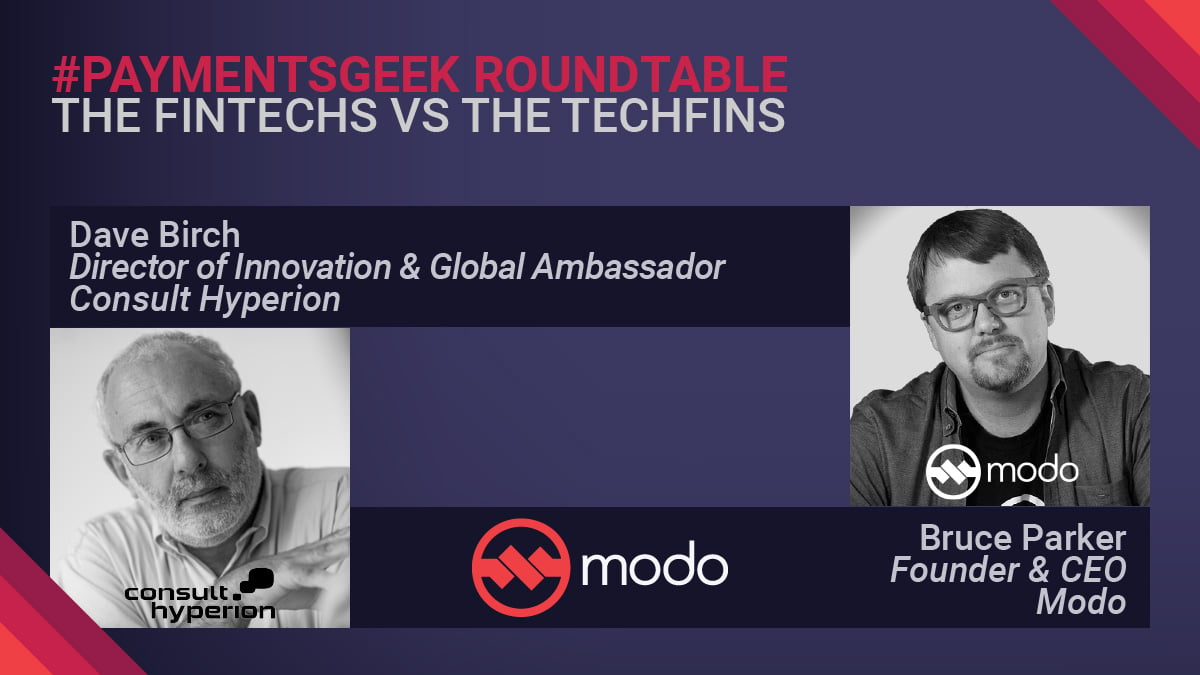

We were glad to welcome a world-renowned #paymentsgeek, Dave Birch from Consult Hyperion, to the #PaymentsGeek Roundtable. Dave spoke with Modo CEO, Bruce Parker, on the differences between fintechs and techfins and what he sees for the future of payments inside enterprises. During the webinar, Dave made several predictions, and we decided to get those in writing* - a time capsule of sorts. Check back in 5-10 years to see if any of these predictions have come true!

Dave’s Predictions

Prediction #1: Restaurants & stores will remain contact free after the pandemic

“The transition to contact free rather than contactless has accelerated quite rapidly. Having experienced the new contact free ordering at restaurants, it’s not transparently obvious to me that people will go back to doing it the old way. The contact free ordering is easy, convenient, and it works. We characterize this as the shift from “checkout” to “check in” - the idea that you check in to places rather than checking out of them. When you scan the code or use location services to announce that you’re in a place, the service providers can deliver a much better service to you because now they know who you are. When you walk in, they know that you’re the guy who bought the toothpaste last week. This transition to contact free rather than contactless has created interesting behavior that you wouldn’t have thought about before. From a payments point of view, it’s not obvious that people will go back to the old way of doing business.”

Prediction #2: We are going to see a significant rise in fraud due to the pandemic

“Now you have zillions of people going online that were never online before. People want to continue buying stuff from their local stores, so now the stores have to get a card reader that they’ve never had before. That means there are millions of people going online who have never been online before who are very susceptible to fraudsters. I fully expect to see a really significant rise in fraud figures as we move through the year.”

Prediction #3: The end of the payments era is near

“I can remember when payments were boring, and then they were exciting and fun. We’re probably coming to the end of that. In reality, in many countries, the instant credit networks have Open Banking sitting on top of them and we have a different set of issues to worry about - digital identity, consent management, authentication. I can fire up my WhatsApp and send $5 to Bruce and under the hood that no longer routes through ISO8583 card networks with bandaids stuck on them but instead gets zipped into 20022 super speed FedNow and a few microseconds later shows up in your account with rich data. Unless I’m really missing something, I can’t help but feel a lot of things are going to move in that direction.”

Prediction #4: APIs are going to become more simple

“We are in a chaotic time, but if you were an up-and-coming executive scanning the horizon in financial services I think I would be looking at how the API ecosystem is going to evolve and develop. Any of you that have lived through the process of publishing and connecting with an API know that it’s just really not that simple. You’ve got to have identification, authentication, authorization, consent management, manage the upgrade cycles, work out how to keep things in sync, you’ve got to keep track of standardization, etc. I think if you were your young self now I don’t doubt you would be looking around for some kind of #APIgeek opportunity. In 20 years, APIs will just be how things work. Right now, there’s a lot of pressure to move in that direction. People who have lived through it know it’s just not that simple.”

Prediction #5: Payments Orchestration is the future

“Orchestration is a word that comes up a lot nowadays. APIs make orchestration a lot easier because you can pull and play different things. You don’t have to rip out a whole infrastructure, instead you can orchestrate. The idea that you orchestrate to take best-of-breed in different areas and present them through a common interface is actually quite a strong proposition. I think the reason why people like the orchestration part of it is because they don’t necessarily want to throw all of their eggs in any one particular basket. I saw a comment recently where somebody said there are 5000 banks in the US but they all run on about 4 different systems. That’s not the future. The future isn’t that you go and buy your banking infrastructure from this particular provider. Maybe you take some services from here, some services from there, and actually it’s constantly shifting as people come up with more innovative, better solutions. The person managing payments doesn’t want to continue making these micro-calculations about which of these platforms or services they should be using. I think that’s a pretty good vision of the future, and I would say marketplace activity would tend to support that view.”

*Quotes have been edited for clarity and brevity